The EU sanctions Russian crude oil as part of a significant effort to cripple Russia’s economic capabilities in light of the ongoing conflict in Ukraine. In a bid to decrease Moscow’s oil revenues, which are crucial for financing its military operations, the latest sanctions package introduces a lower price cap for Russian crude purchases. This strategic move aligns with the G7 oil purchasing restrictions that are designed to limit non-G7 countries’ access to essential logistics services if they exceed the agreed price threshold. By tightening these financial constraints, the European Union aims to maintain stability in the crude oil market while ensuring that Russian profits are significantly reduced. As these sanctions unfold, the implications for global energy dynamics, particularly concerning Russia energy sanctions, remain paramount.

The recent developments concerning EU sanctions on Russian crude oil highlight the bloc’s commitment to addressing the geopolitical tensions surrounding energy supplies. This measure, part of a broader sanctions package, aims to diminish the financial lifeline that fuels Russia’s military endeavors. By imposing a new price ceiling on oil transactions and enhancing restrictions on shipping services, the EU seeks to discourage reliance on Russian resources from other global players. As the crude oil landscape evolves, these moves could significantly reshape international trading dynamics, particularly with non-G7 nations that previously sourced Russian energy. The careful balancing act between limiting Moscow’s oil revenues and preventing a worldwide energy crisis underlines the complexities of this ongoing situation.

Overview of the EU’s New Sanctions Package

The European Union has made significant strides in its geopolitical strategy by agreeing on a new sanctions package aimed explicitly at crippling Russia’s economic resources amid ongoing tensions. As part of this package, EU policymakers have decided to lower the price cap on Russian crude oil, which primarily affects non-G7 countries. This is a critical maneuver as it aims to further limit Moscow’s revenues derived from oil sales, which have been a cornerstone of its economy since the 2022 invasion of Ukraine.

The sanctions package reflects a coordinated effort among EU nations to target not just the energy sector but also Russia’s banking and military-industrial complexities. By lowering the Russian oil price threshold and targeting firms like Rosneft, the EU is tightening its grip on the layers of Moscow’s economic infrastructure. This shows the bloc’s commitment to financially debilitating the war effort, while also ensuring that oil supplies remain to mitigate any risk of drastic shortages in the crude oil market.

Impact of Lowered Price Cap on Russian Oil Exports

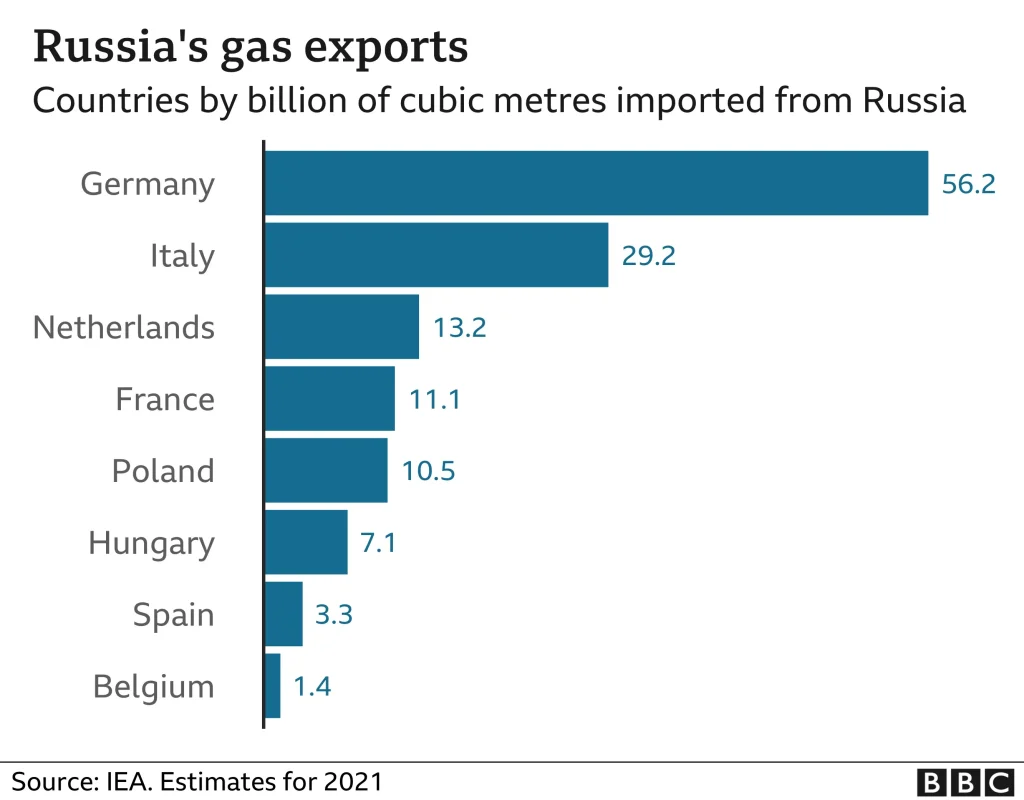

Lowering the price cap on Russian crude oil directly impacts the export dynamics, particularly for countries outside the G7. The shift aims to discourage buyers from purchasing Russian oil above the established threshold, thereby straining the country’s ability to fund military operations and other state needs. Notably, Russian oil previously seen as a staple for European refiners is increasingly directed to markets in China and India, who may not be as affected by these price cap measures.

This strategic decision by the EU places significant pressure on Russia to adapt to changing global oil market conditions, further isolating it from its traditional trading partners. The ongoing sanctions and the aggressive G7 oil purchasing policies are intended to create a ripple effect, pushing global oil prices in favor of alternative energy suppliers and reducing Russia’s bargaining power in international energy talks.

The Geopolitical Ramifications of Sanctions on Russia

The geopolitical ramifications of the EU’s decision to lower the price cap for Russian crude are manifold. By aggressively targeting Russia’s energy sector through these new sanctions, the EU aims to reshape the power dynamics within global energy markets. This not only alters the economic landscape for Russia but also for nations reliant on its oil exports, potentially leading to a re-evaluation of energy dependencies across Europe and beyond.

Furthermore, as the EU and G7 implement these stronger measures, the likelihood of retaliatory actions from Russia increases. This can lead to various countermeasures, including potential reductions in oil supply or aggressive pricing strategies aimed at destabilizing emerging markets that have aligned with non-G7 countries. The ongoing tug of war between energy sanctions and geopolitical maneuvers will likely dominate the international dialogue surrounding energy and economic stability for the foreseeable future.

Monitoring Compliance with the New Price Cap

As the EU enacts this new sanctions package, a crucial element remains the monitoring of compliance across various jurisdictions. With the lowered price cap on Russian crude oil, it is vital that mechanisms are established to ensure that non-G7 nations adhere to the regulations surrounding oil purchases and logistical support from G7 countries. Failure to effectively monitor these compliance measures may lead to loopholes that could undermine the impact of the sanctions.

Moreover, transparency in monitoring and strict penalties for non-compliance can serve as deterrents to nations tempted to overlook the sanctions for short-term economic benefits. This ensures that the integrity of the EU’s sanctions strategy remains intact as it strives to impose strict limitations on how Russia can leverage its energy resources. The success of the new sanctions package will heavily depend on a collaborative international effort to enforce and abide by the price cap regulations.

Future Outlook for Russia’s Energy Sector

The future outlook for Russia’s energy sector appears increasingly bleak with the introduction of the EU’s latest sanctions package. By reducing the price cap on crude oil, potential revenue loss becomes even more significant, which could lead to a contraction in production and innovation within the sector. The continued ambitions of the EU to hinder Russia’s oil revenues may catalyze a long-term decline in its oil output capabilities, further isolating it on the global stage.

Additionally, the potential shift toward renewable energy sources among Europe and G7 nations may diminish the influence of Russian oil in the long-term. Investment in alternative energy sources and technology could render traditional energy trading relationships obsolete, compelling Russia to adapt or fall behind. The broader implications of the enforced sanctions may thus lead to a transformative shift, recalibrating the global energy market toward sustainable practices, leaving Russia struggling in a rapidly evolving landscape.

Understanding the Mechanisms of Energy Sanctions

Understanding the mechanisms behind energy sanctions is crucial for grasping their effectiveness and implications. The EU’s recent decision to lower the price cap for Russian crude oil exemplifies the strategic use of economic measures to influence state behavior. Energy sanctions not only target financial resources but also seek to dismantle the logistical and operational frameworks that allow countries like Russia to maintain their energy exports and revenue streams.

The integration of G7 logistics services restrictions further complicates access to the global oil market. By utilizing a combination of financial, operational, and trading barriers, the EU is constructing a robust framework that not only aims to reduce Russia’s capabilities but encourages other nations to subject themselves to similar sanctions, thereby reinforcing collective international pressure. This creates an environment of shared responsibility among participating nations and aligns various geopolitical interests under a common objective.

Influence of the G7 on Global Oil Pricing

The G7’s influence on global oil pricing has been significantly shaped by its actions to enforce a price cap on Russian crude oil. As major economies, the G7 countries hold substantial sway over energy markets, and their collective decisions impact pricing structures worldwide. The newly agreed sanctions package, which includes the lowered price cap, is a testament to their commitment to addressing geopolitical tensions through economic means.

Moreover, the active role of the G7 in managing oil pricing creates a broader narrative about energy security and economic stability. As non-G7 countries navigate their purchasing decisions relative to Russian crude, G7 policies can lead to recalibrations of trade dynamics, ultimately influencing market prices and supply chains on a global level. This interconnectedness highlights the importance of coordinated international approaches in stabilizing or destabilizing oil markets.

Reactions from Non-G7 Nations

Reactions from non-G7 nations to the EU’s sanctions package and the lowered price cap on Russian crude have been varied and complex. Some nations may view the new sanctions as an encroachment on their sovereign rights to access energy resources, potentially leading to diplomatic tensions. Countries heavily reliant on Russian oil may find it challenging to navigate compliance while managing the impacts on their domestic economies.

Conversely, other nations may seek to capitalize on the void left by restricted access to Russian oil, highlighting the dynamic nature of global energy markets. This creates an opportunity for alternative suppliers, including those in the Middle East and North America, to increase their market share as buyers look for stable and compliant energy sources. The varying responses from these nations will significantly shape the landscape of international relations and energy trading practices moving forward.

The Role of Logistics in Oil Sanctions

The role of logistics in the enforcement of oil sanctions cannot be understated, particularly when looking at the nuances of the EU’s new sanctions package. The link between logistical services provided by G7 countries and the price cap on Russian crude oil creates a complex web of dependencies that could either bolster or weaken the effectiveness of the sanctions. This emphasis on logistics plays a pivotal role in determining how non-G7 countries can acquire Russian oil.

Logistical barriers, such as insurance and transportation limitations imposed by G7 countries, serve as critical tools in restricting Russia’s access to favorable trading conditions. By targeting the logistical channel, the EU aims to create significant operational challenges for Russia, effectively reducing its ability to transport and sell oil at competitive prices. Such strategic maneuvering reinforces the sanctions’ overall objective to diminish the economic clout of Russia in the crude oil market.

Frequently Asked Questions

What are the implications of the EU sanctions on Russian crude oil?

The EU sanctions on Russian crude oil aim to decrease Russia’s oil revenues, a key source of funding for its military operations. These sanctions include a price cap restricting the amount non-G7 countries can pay for Russian crude while utilizing G7 logistical services. This strategy not only pressures Russia’s economy but also seeks to stabilize the global crude oil market, preventing supply shortages.

How does the Russian oil price cap impact global oil prices?

The Russian oil price cap established by the EU and G7 directly influences global oil prices by setting a maximum purchasing price for Russian crude. This limit aims to reduce Russia’s revenues while ensuring that Russian oil remains available in the market, thus avoiding severe disruptions that could lead to skyrocketing prices.

What is the recent change in the EU sanctions package for Russian crude oil?

The recent EU sanctions package has introduced a lower price cap for Russian crude oil, enhancing measures to hinder Russia’s war financing. This new cap indicates a strategic shift as Euro leaders aim to tighten economic pressures further on Russia while managing the implications for the global crude oil market.

How can non-G7 countries purchase Russian crude oil under EU sanctions?

Non-G7 countries can purchase Russian crude oil as long as they do not exceed the established price cap while using G7 logistics and insurance services. This mechanism allows them to engage in trade with Russia while adhering to the sanctions imposed by the EU and the G7 to limit the Russian economy’s war funding.

What role do G7 countries play in the EU sanctions against Russian oil?

G7 countries play a crucial role in the EU sanctions against Russian oil by establishing price caps and restricting access to shipping and insurance services for transactions involving Russian crude. Their coordinated efforts enhance the effectiveness of the sanctions aimed at curtailing Russia’s oil revenue and thereby its military capabilities.

Why is there a focus on lowering the Russian oil price cap in the latest sanctions?

The focus on lowering the Russian oil price cap in the latest sanctions is part of an ongoing effort to increase economic pressure on Russia. By reducing the price threshold, the EU aims to limit Russia’s oil revenue further while ensuring the crude oil market remains stable by preventing drastic shortages.

What are the consequences for countries that violate the Russian oil price cap?

Countries that violate the Russian oil price cap risk facing sanctions from the EU and G7 nations, which may include restrictions on financial transactions, trade, and access to logistics services. Such penalties are designed to enforce compliance with the sanctions aimed at diminishing Russia’s economic resources for military expenditure.

How have EU sanctions affected the flow of Russian crude oil to global markets?

EU sanctions have redirected the flow of Russian crude oil from traditional European markets to countries like China and India. As European refiners seek alternatives, Russia has adjusted its export strategy, increasing sales to non-Western markets while navigating the restrictions imposed by the EU sanctions.

| Key Point | Details |

|---|---|

| Price Cap Lowered | Non-G7 countries will now have a lower price limit to purchase Russian crude under EU sanctions. |

| Targeting Key Sectors | The sanctions specifically aim at Russia’s banking, energy, and military-industrial sectors to disrupt its war efforts. |

| Dynamic Oil Price Cap | New measures include a dynamic component to the oil price cap that will adjust to market conditions. |

| Implications for Purchasers | Non-G7 buyers paying over a specified threshold will be banned from using G7 transport and insurance services. |

| Impact on Russia | Designed to limit Russia’s oil revenues, crucial for its economy, while maintaining market supplies to prevent shortages. |

Summary

EU sanctions on Russian crude oil involve lowering the price cap at which non-G7 countries can purchase Russian crude. This strategic move aims to further undermine Russia’s funding for its military and war efforts while targeting essential economic sectors such as banking and energy. By adjusting the oil price cap, the EU seeks to limit Russia’s oil revenue without causing a significant disruption in global oil supply.