Global Markets in a Post-Pandemic Era signals a new framework for how economies, companies, and investors respond to a world still recalibrating after COVID-19 disruptions. In this environment, post-pandemic market volatility has shifted from a crisis spike to a nuanced rhythm that can reveal tactical opportunities for patient capital. By highlighting evolving policy backdrops, supply-chain realignments, and regional growth patterns, the landscape is rich with global market opportunities for diversification and resilient earnings. The emphasis remains on disciplined risk management, forward-looking indicators, and scalable investment ideas aligned with longer-term goals. This introductory overview sets the stage for practical thinking on how to interpret shifts, capture asymmetric upside, and adapt as conditions evolve.

Seen through an LSI lens, the discussion shifts from a crisis narrative to a broader global markets outlook defined by evolving policy, technology, and productivity trends. Rather than focusing on a single megatrend, investors map multiple scenarios tied to recovery trajectories, supply-chain realignments, and regional growth differentials. This approach emphasizes diversification across geographies and sectors, along with disciplined risk controls and mindful cost management. By reframing the dialogue in these terms, readers can identify resilient themes—digital enablement, sustainable infrastructure, and quality balance sheets—that endure beyond near-term volatility.

Global Markets in a Post-Pandemic Era: Navigating Volatility to Unearth Global Market Opportunities

Global Markets in a Post-Pandemic Era frames how investors interpret a world still recalibrating after COVID-19 disruptions. The concept of post-pandemic market volatility has shifted from crisis spikes to a more nuanced rhythm shaped by inflation dynamics, policy normalization, and ongoing realignments in supply chains. This environment presents a spectrum of global market opportunities, rewarding those who distinguish durable trends from short-term noise and who align exposures with longer-term earnings resilience.

In this frame, regional leadership matters: North America often leads in technology and healthcare, Europe benefits from energy transitions and governance improvements, and Asia shows pockets of rapid growth tied to manufacturing realignment and rising consumer strength. A disciplined approach requires tracking the global markets outlook across regions and sectors, balancing risk against potential returns while maintaining flexibility to adapt to evolving macro signals. The goal is to translate volatility into selective entries and to build a diversified stance that can endure varied cycles.

Economic Recovery after COVID-19: Investment Strategies Post-Pandemic for a Resilient Global Portfolio

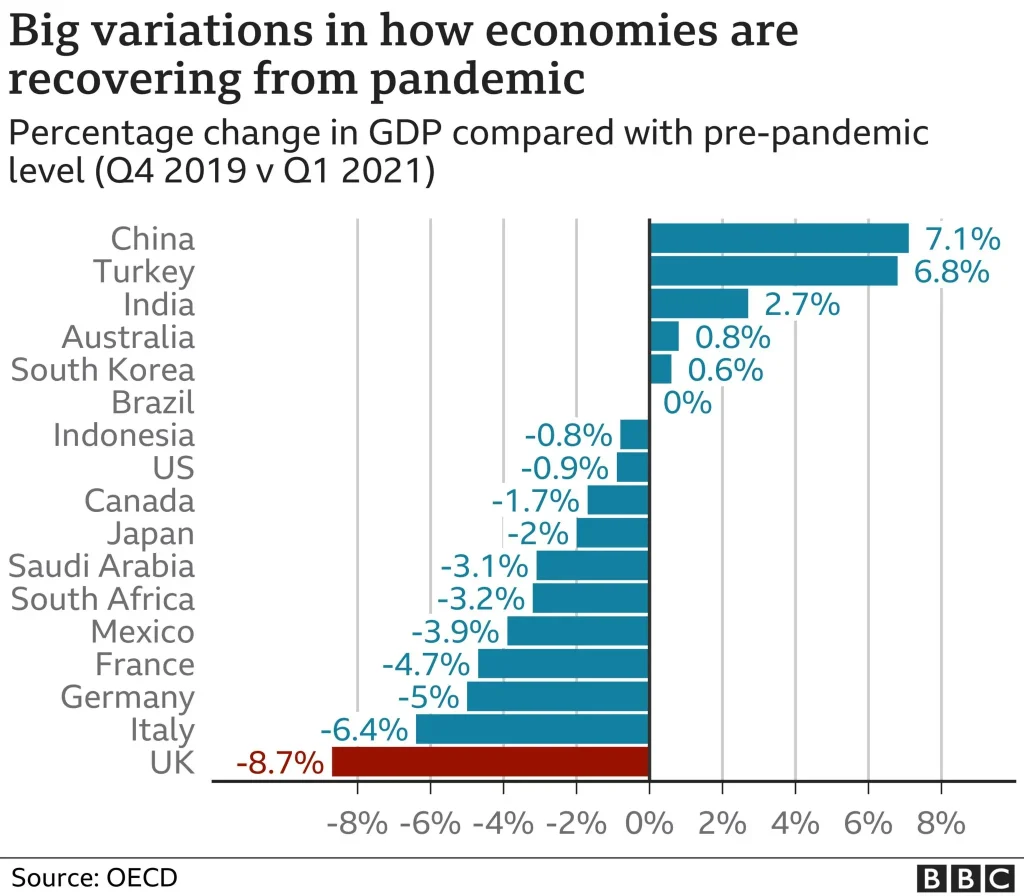

Economic Recovery after COVID-19 is not uniform across economies, creating a map of opportunities and risks for investors. While some regions show resilient demand, others struggle with labor markets, supply constraints, or energy prices. Investors seeking to navigate this landscape should monitor key indicators of the recovery, such as GDP momentum, employment trends, and productivity gains, as these metrics influence risk appetite and asset allocation. The lens of investment strategies post-pandemic emphasizes patience and structural alignment with the trajectory of the recovery, rather than chasing short-term swings.

A practical blueprint for the post-pandemic era includes strategic asset allocation across equities, fixed income, real assets, and cash, complemented by quality screens and diversification to cushion drawdowns. Focus on durable franchises with strong balance sheets, sustainable cash flows, and resilience to inflation and rate shocks. Geographic diversification remains essential to capture global market opportunities, while risk controls—position sizing, hedging, and cost discipline—help protect portfolios through potential downturns. By centering on themes like digital transformation, healthcare innovation, and energy transition, investors can align with the global markets outlook and participate in the economic recovery after COVID-19 over the long term.

Frequently Asked Questions

In the Global Markets in a Post-Pandemic Era, what drives post-pandemic market volatility, and how can investors turn volatility into opportunities?

Post-pandemic market volatility is driven by the pace of economic recovery after COVID-19, central bank policy normalization, inflation dynamics, supply-chain realignments, and geopolitical shifts. This volatility is not merely a risk but also a set of entry points for patient investors who distinguish temporary swings from durable trends. To capitalize on opportunities, focus on fundamentals, differentiate regions and sectors with resilient earnings, and maintain disciplined risk controls and diversification. Monitor macro indicators, valuations, and earnings quality, and tilt toward areas with structural tailwinds such as digitization, energy transition, and health innovation to access global market opportunities while managing drawdowns.

In light of the global markets outlook, how should investors shape investment strategies post-pandemic to align with the economic recovery after COVID-19?

The global markets outlook suggests a balanced, long-horizon approach. Investment strategies post-pandemic should combine a durable core with selective tactical bets guided by risk controls and ongoing macro monitoring. Build a diversified framework across developed and emerging markets, select themes like technology, healthcare, and energy transition, and maintain liquidity to capture opportunities during volatility. Regularly revisit asset allocation in response to the pace of the economic recovery after COVID-19, inflation dynamics, and policy shifts, ensuring earnings quality and disciplined capital allocation drive long-term returns.

| Theme | Core Idea | Practical Takeaways |

|---|---|---|

| Volatility-versus-opportunity dynamic | Post-pandemic volatility is a spectrum; it creates entry points, but investors must distinguish temporary noise from durable trends. Inflation and policy expectations drive regional rotations; near-term dynamics may differ from longer‑term secular shifts. | Turn volatility into opportunities; stay flexible with exposures and risk controls; align decisions with longer-term goals. |

| Regional and sector opportunities across the globe | North America often leads with tech and healthcare; Europe benefits from energy transitions and governance improvements; Asia shows resilient growth and manufacturing realignment; emerging markets offer diversification with liquidity considerations. | Apply a disciplined framework to select opportunities across regions and sectors; diversify to manage idiosyncratic risk. |

| Economic recovery after COVID-19: what to watch | Recovery pace matters for asset prices. Monitor GDP growth, unemployment, inflation, wages, productivity, and supply-chain normalization. The policy mix (monetary vs fiscal) shapes risk and returns. | Maintain flexibility in duration/credit exposure; diversify to cushion macro shocks; adjust allocations as macro signals evolve. |

| Investment strategies post-pandemic: a practical blueprint | A balanced approach combines core holdings with selective tactical bets, anchored by a durable asset allocation, quality bias, global diversification, risk controls, thematic exposure, and cost awareness. | Establish a repeatable framework and review it periodically as signals evolve; emphasize risk controls and cost efficiency. |

| A framework for choosing investments in a post-pandemic world | Start with a macro thesis (optimistic, base, or cautious) and test it against revenue growth, margins, and cash flow quality. Consider ESG and earnings quality beyond past multiples. | Use a disciplined, thesis-driven approach to select investments and reassess as conditions change. |

| Risk considerations and protection against downturns | Inflation surprises, policy missteps, and geopolitical events can trigger rapid price moves. Diversification, liquidity buffers, and currency-risk awareness are essential; hedging may be appropriate. | Build strong diversification, maintain liquidity, and consider hedging strategies to reduce drawdowns in stressed markets. |

Summary

Global Markets in a Post-Pandemic Era define a nuanced landscape where volatility coexists with opportunity, and disciplined, cross‑regional approaches help investors navigate shifting policy dynamics and evolving growth trajectories. In this era, diversification across regions and sectors, a focus on quality balance sheets, and a framework that blends strategic asset allocation with selective tactical bets enable long-term resilience. As digitization, energy transition, and supply chain realignments reshape industries, investors can pursue sustainable, long‑term returns by staying informed, remaining flexible, and adapting to new information as conditions evolve.