Global travel recovery is reshaping how destinations, airlines, hospitality brands, and travelers approach mobility in a post-disruption era, and it is guiding how policymakers plan infrastructure, marketing, and customer experiences for years to come. As borders reopen and consumer confidence returns, the recovery momentum is visible across many regions. Policymakers and operators are tracking post-pandemic travel demand signals, balancing safety with value to invite longer or more frequent trips. Travel restrictions easing across key corridors reduce friction for crossing borders and help sustain momentum toward a broader international audience. Together, these factors illuminate a dynamic landscape where travelers expect flexible terms, meaningful experiences, and reliable service from trusted brands.

Across regions, the rebound in international travel signals a broader revival of cross-border mobility and leisure exploration. Industry observers describe a tourism sector resurgence, with hotel occupancy, airline seats, and tour offerings expanding in tandem with renewed traveler enthusiasm. As consumers seek value, flexibility, and safer experiences, the travel industry is recalibrating product mixes and pricing to capture emerging demand. Behind the headlines, recovery is shaped by digital tools, sustainable practices, and collaborative strategies that connect destinations, carriers, and communities.

Global travel recovery: current trends and opportunities

Global travel recovery trends show a mosaic of progress, with leisure travel rebounding faster than business travel and families reuniting for experiences, nature escapes, and culturally rich itineraries. The tourism industry rebound is evident in airline capacity, hotel occupancy returning toward sustainable levels, and tour operators expanding to capture a broader mix of traveler segments. As travel restrictions easing across key corridors continue, post-pandemic travel demand remains robust among travelers seeking value, flexibility, and safer, more predictable journeys.

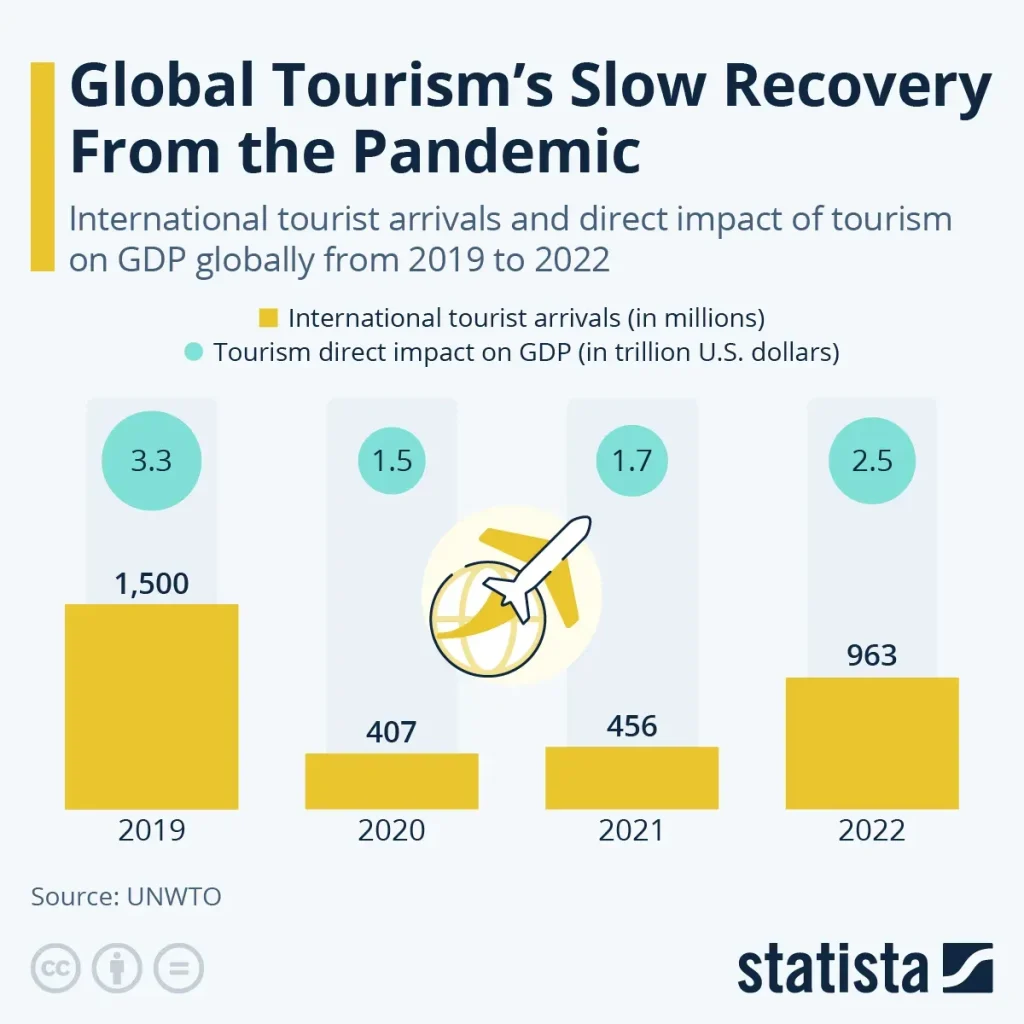

Yet the pace and pattern of recovery vary by region. International travel recovery stats reveal uneven momentum, with some markets posting strong inbound demand while others lag behind. Technology—digital health verification, contactless services, AI-driven pricing, and data-driven destination marketing—accelerates the rebound by reducing friction and increasing traveler confidence. Regions that diversify visitor sources and prioritize sustainable, responsible travel are more likely to sustain momentum and deliver resilient, long-term growth.

Strategies to thrive in the tourism industry rebound: resilience, value, and innovation

To capitalize on the tourism industry rebound, operators should align product design and capacity with the rebound in post-pandemic travel demand. Airlines and hotels can boost resilience by offering flexible booking options, diversified pricing, and transparent health and safety measures, supported by loyalty programs and multi-risk insurance. Destination marketing organizations can harness data analytics and digital experiences to personalize campaigns, ensuring travel restrictions easing translates into real bookings and repeat visits.

Travel platforms and stakeholders must prioritize sustainable growth and inclusive experiences to broaden the traveler base. By investing in safety protocols, community-led initiatives, and authentic local experiences, destinations can spread benefits more evenly and reduce seasonal dependency. Embracing technology-enabled efficiency—from contactless processes to predictive analytics—helps manage capacity, improve on-time performance, and build trust with travelers, aligning with international travel recovery stats and long-term expectations for a more resilient global travel ecosystem.

Frequently Asked Questions

What do global travel recovery trends reveal about the pace of leisure travel vs. business travel, and how should industry players respond?

Global travel recovery trends indicate leisure travel is rebounding faster than business travel, as travelers seek experiences and flexible arrangements. Because regional performance varies, airlines, hotels, and destinations should diversify capacity, simplify booking policies, and invest in trusted health and safety measures to capitalize on post-pandemic travel demand. As travel restrictions easing reduces border friction, stronger partnership networks and targeted marketing can sustain momentum across key markets.

What factors are driving the tourism industry rebound, and how can travelers use international travel recovery stats to plan trips with confidence?

The tourism industry rebound is driven by pent-up post-pandemic travel demand, flexible booking terms, enhanced health protocols, and the easing of travel restrictions in many corridors. Travelers can use international travel recovery stats to gauge risk and timing, while prioritizing flexible itineraries, transparent terms, and reliable support from operators to plan resilient trips.

| Aspect | Key Points | Notes |

|---|---|---|

| Trends shaping global travel recovery | Leisure travel rebounds faster; regional differences; demand for experiences; more international travelers and capacity growth in tours, flights, and hotels. | Shows a mosaic of patterns rather than a single path; rebound visible across sectors. |

| Post-pandemic demand drivers | Value, flexible booking options, transparent health/safety measures, and cancellable trips; multi-risk insurance options; flexible terms by providers. | Trips can be adjusted without heavy penalties; boosts traveler confidence. |

| Technology as recovery accelerant | Digital health verification, contactless check-in, AI-driven pricing, personalized recommendations; data analytics for marketing; streamlined visa processes. | Enhances safety, reduces friction, and improves predictability for travelers. |

| Regional diversity matters | Domestic/regional growth leads in some markets; inbound travel more important in others; diversification of visitor sources; emphasis on sustainable travel. | Leads to varied rebound curves and planning considerations. |

| Supply side improvements | Rebuilt schedules, added routes, revamped loyalty programs, improved service quality; capacity expansion across airlines, hotels, and operators. | Supports trust and broader market reach. |

| Challenges to navigate | Inflation/fuel costs; macroeconomic volatility; geopolitical and security concerns; visa/quarantine policy changes; labor shortages; sustainability expectations; uneven regional recovery; travel advisories; demand shifts. | Requires agility in capacity, pricing, and product mixes. |

| Opportunities for a resilient ecosystem | Route optimization, rail/road partnerships; flexible cancellation and safety protocols; personalized experiences; sustainable practices; data-driven marketing; transparent pricing; inclusive experiences. | Builds resilience and trust across the ecosystem. |

| What this means for travelers and industry players | More options, better safety, and planning; flexible terms and strong support networks; for businesses, growth potential balanced with risk management and contingency planning. | Emphasizes value, safety, and adaptability for all stakeholders. |

Summary

HTML table above summarizes the key points from the base content.