Trump tariffs have sparked intense debate and concern in the realm of international economics, particularly following President Donald Trump’s recent announcement of sweeping new duties on a range of goods from multiple U.S. trade partners. These tariffs, which range from 10% to 41%, represent a significant shift in America’s trade policies, aiming to reshape the landscape of global commerce. As the U.S. imposes these increased tariff rates, the implications for domestic inflation and economic growth are dire, leading many experts to predict a notable impact on the global trade conflict. World leaders and economists alike are closely monitoring how these tariffs will influence businesses, consumer sentiment, and trade relationships moving forward. With stakes this high, the repercussions of Trump’s trade initiatives are poised to resonate well beyond American borders, igniting discussions on protectionism and trade balance.

In the arena of international commerce, the recent adjustments to U.S. tariff policies—often referred to as Trump’s economic sanctions—are causing ripples across various markets and economies. The newly instituted duties signal a recalibration of reciprocal trade relationships between the U.S. and its partners, further complicating an already tense global trade conflict. Analysts have warned that this wave of tariffs will not only reshape existing trade dynamics but also set a precedent for future interactions between the United States and other nations. As trade partners react to these shifts, concerns surface about their specific economic vulnerabilities and the potential for increased domestic prices. Therefore, understanding the full scope of these trade policies is crucial for navigating the intricate web of international economic relations.

The Impact of Trump Tariffs on Global Trade

The recent sweeping tariffs announced by President Trump are set to alter the landscape of global trade dynamics significantly. With rates ranging from 10% to 41% applied to numerous trade partners, the ripple effects of these tariffs could lead to a major upheaval in international commerce. Economists predict that such tariff hikes will not only exacerbate tensions in the already complicated U.S. trade relationships but may also intensify the global trade conflict. As U.S. companies reconsider their supply chains, many will face increased costs that could ultimately lead to inflationary pressures in the domestic market.

The implications of Trump’s tariffs are vast. Countries that rely heavily on exporting to the U.S. might find themselves at a disadvantage, facing higher barriers to trade. This potential decline in trade volume could ripple outward, affecting global GDP and creating a slowdown in economic growth. Furthermore, U.S. trade partners are likely to retaliate with their tariffs, creating a tit-for-tat scenario that can destabilize established trading systems and relationships.

Responses from U.S. Trade Partners

In light of the newly imposed tariffs, U.S. trade partners have begun voicing their concerns regarding the economic impact. Countries like Malaysia and Switzerland have received exemptions for key sectors, reducing potential impacts on important economic drivers such as semiconductors and pharmaceuticals. Malaysian officials, for example, emphasized that their critical semiconductor exports would remain tariff-free, showcasing an effort to protect a vital sector of their economy from the blow of U.S. tariff policies.

Similarly, the Swiss pharmaceutical sector’s exclusion from tariff rates suggests that nations are actively negotiating and advocating for their economic interests amid rising tensions. Such advantages could offer a lifeline for those industries, yet the broader effects of tariff increases loom ominously, prompting countries like South Africa to seek an urgent resolution to combat the potential damage caused by the tariff regime.

Forecasting Economic Outcomes of Tariffs

Analysts are grappling with the complexities introduced by Trump’s new tariff system and the economic forecast shows potential for both domestic and international disruption. The anticipated rise in domestic inflation signals a fundamental shift in pricing throughout markets, which could lead to decreased consumer spending. Particularly, sectors reliant on imports are likely to see diminished profit margins, further complicating economic stability as businesses pass on costs to consumers.

Furthermore, global trade forecasts are becoming increasingly cautious as many experts predict a prolonged period of uncertainty due to these tariff adjustments. As businesses await clarity on trade policies, there’s apprehension surrounding investment decisions and long-term strategies. The landscape of global commerce is shifting, and it remains to be seen how U.S. companies will adapt to these tariff changes while managing relationships with international partners.

The Risks of Retaliation in Global Trade

The potential for retaliation from other nations presents a significant risk in the context of Trump’s renewed tariffs. As countries respond with their tariffs, the global trade conflict may escalate, leading to an unstable trading environment. Analysts warn that retaliatory tariffs could target U.S. products, exacerbating losses for American exporters and skewing the balance in trade negotiations.

This back-and-forth could foster an environment of uncertainty, where businesses may hesitate to engage in international trade due to fear of sudden changes in tariff regulations. The trade relationships that have taken years to establish could unravel quickly, leading to a fragmented global market where protectionist policies prevail over free trade principles.

Domestic Industries Feeling the Effects of Tariffs

While the intent behind Trump tariffs may be to protect U.S. industries, many domestic sectors are expressing concern over the increased costs of imported goods. Industries that rely on raw materials from abroad will face heightened expenses as tariffs raise input costs, potentially squeezing margins and leading to job cuts. For instance, manufacturers who depend on steel and aluminum imports are likely to feel increased pressure as they navigate higher production costs.

Additionally, consumers could bear the brunt of these tariffs through higher prices for everyday goods. As retailers adjust their pricing strategies to account for increased operational costs, inflation rates may climb further, complicating the economic landscape for U.S. households. The true cost of Trump’s tariff policies may thus be reflected in consumer wallets, reigniting debates over the effectiveness of such measures in stimulating U.S. economic growth.

Global Reactions to Trump’s Trade Policies

Responses to Trump’s trade policies have varied across the globe, with many countries expressing trepidation over the possible fallout. From the European Union to key Asian partners, reactions range from negotiating exemptions to lodging formal protests against the U.S. tariffs. The EU trade chief noted that these adjustments appear to reflect recent agreements, suggesting a thinly-veiled attempt at multilateral negotiation amidst a tense geopolitical climate.

The diversely tailored responses signify an awareness among international leaders about the potential repercussions of Trump’s tariffs on global harmony and trade alliances. As nations brace for impact, the importance of diplomatic engagement and strategic negotiation tactics becomes increasingly vital in mitigating the adverse effects of these tariffs.

The Long-term Consequences of Tariffs on Trade Relationships

Over time, the ramifications of Trump tariffs may extend beyond immediate economic impacts, reshaping long-standing trade relationships. Nations that find themselves unfairly burdened by U.S. tariff rates may begin to seek alternative trading partners or develop internal capabilities, potentially diminishing reliance on U.S. goods and services. This shift could lead to a realignment of global trade networks, as countries prioritize the establishment of new alliances that do not involve U.S. participation.

Moreover, the evolution of trade relationships in response to tariffs could usher in a period of increased protectionism globally. As countries scramble to manage their own economic interests in light of U.S. policy adjustments, a fragmented trade environment may emerge, characterized by a shift away from multilateralism, which could stifle global trade efficiency in the long run.

Economic Predictions Amid Tariff Adjustments

Economic forecasts in the wake of Trump tariffs have become increasingly somber, with many analysts predicting adverse effects for the U.S. economy. The potential for rising inflation, coupled with slower economic growth, raises concerns about the sustainability of Trump’s trade policies. Economists like Atakan Bakiskan of Berenberg have already cautioned that these policies could constitute a significant blow to both the domestic economy and global trade activities.

Moreover, the uncertainty surrounding the tariffs might lead businesses to be more cautious in their investment strategies, which could hinder job creation and wage growth in the U.S. As the economic landscape evolves, keeping an eye on both domestic output and trade dynamics will be crucial for understanding the enduring impacts of these tariffs.

Negotiating Tariff Exemptions: A Strategic Move

Countries facing new tariff rates have started negotiations to secure exemptions, signaling a strategic approach to navigate these changes. Nations like Malaysia have had success in preserving their semiconductor exports from tariffs, highlighting how engagement and diplomacy can yield positive outcomes in challenging trade scenarios. Such negotiations serve not only to protect individual sectors but also as a means to strengthen bilateral relationships.

The strategic maneuvering among trade partners emphasizes the importance of foresight in tariff negotiations. As countries aim to safeguard their economic interests, the outcomes of these discussions could set precedents for future trade agreements, with long-lasting implications for U.S. business operations and global trade relations.

Conclusion: The Future of Global Trade in Light of New Tariffs

In summary, Trump’s latest tariff policies mark a pivotal shift in the global trade landscape, generating a complex interplay of responses from U.S. trade partners and laying the groundwork for significant economic shifts. As these tariffs pose risks of retaliation and impact numerous sectors, the long-term implications for global commerce remain uncertain. With economists warning of rising inflation and slower growth, the stakes are high for U.S. industries and international allies alike.

As the world adjusts to the new trade environment characterized by Trump’s tariff policies, it will be essential for nations to find common ground through negotiation and collaboration. The prospect of navigating the impending challenges posed by tariffs will depend on the ability of countries to engage constructively, ensuring that the principles of fair trade prevail amidst a backdrop of rising tensions.

Frequently Asked Questions

What are the latest changes in Trump tariffs impacting U.S. trade partners?

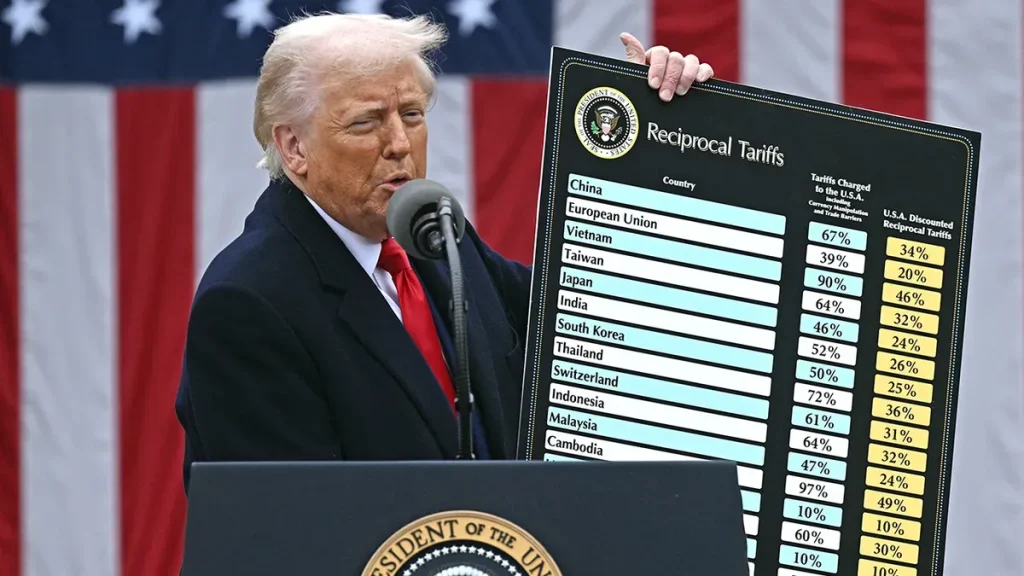

U.S. President Donald Trump recently signed an executive order adjusting tariffs on a variety of countries, with rates ranging between 10% and 41%. These new Trump tariffs are part of ongoing efforts to address trade imbalances and have generated significant responses from global trade partners.

How do Trump tariffs affect global trade conflict?

Trump tariffs have intensified the global trade conflict by imposing higher duties on goods from U.S. trade partners, prompting retaliatory measures and negotiations. Economists warn that these tariffs could lead to increased inflation domestically and slower economic growth.

What is the anticipated impact of Trump tariffs on the U.S. economy?

The anticipated impact of Trump tariffs includes elevated domestic inflation and slower economic growth according to analysts. The adjustments to tariff rates are expected to deliver a significant blow to global commerce, affecting various sectors within the U.S. economy.

Which U.S. trade partners are most affected by the new Trump tariffs?

Countries such as South Africa, Malaysia, and Japan are significantly impacted by the new Trump tariffs. For instance, South Africa faces a 30% tariff rate, while Malaysia’s critical semiconductor exports have been negotiated for exemption.

Are there any sectors exempt from the Trump tariffs?

Yes, certain sectors are exempt from the new Trump tariffs. The Swiss pharmaceutical sector, for example, will not be affected by the 39% tariffs, reflecting efforts by affected nations to shield critical industries from tariffs.

What do economists say about the ramifications of Trump’s trade policies?

Economists express that Trump’s trade policies, including the recent tariff adjustments, are likely to create large impacts on global trade and could lead to increased uncertainties in business and consumer sentiments worldwide.

How are global markets responding to Trump tariffs?

Global markets are reacting negatively to Trump tariffs, with indices in Asia-Pacific closing lower due to concerns over potential impacts on international trade and economic performance.

What are the potential future developments regarding Trump tariffs?

Future developments regarding Trump tariffs could include more adjustments and retaliatory actions from other countries as they seek to negotiate trade deals to alleviate the economic impacts resulting from these tariff changes.

| Key Point | Details |

|---|---|

| Trump’s Executive Order | Modified tariffs on various countries, ranging from 10% to 41%. |

| Impact on Global Trade | Berenberg economist forecasts significant blow to global commerce, predicting domestic inflation and slower growth in the U.S. |

| Exemptions to Tariffs | Malaysia’s semiconductor exports and Switzerland’s pharmaceutical sector, both critical for their economies, are exempt from new tariffs. |

| Reactions from Asia-Pacific | Markets in the region closed lower, indicating negative sentiment following the announcement. |

| Concerns from Other Nations | South African President expresses concern over a 30% tariff on their goods, seeking negotiations to ease impact. |

| EU and U.S. Trade Relations | EU trade chief states new tariffs reflect recent deals with trading partners like Japan and the EU. |

Summary

Trump tariffs have emerged as a significant factor in the ongoing global trade landscape, with sweeping changes announced on August 1, 2025. The newly structured tariffs pose serious implications for both domestic and international markets, sparking concerns of inflation and economic slowdown in the U.S. While some nations like Malaysia and Switzerland manage to avoid the newly imposed duties, others express apprehension over the economic impacts, highlighting the unpredictable nature of Trump’s tariff policies.